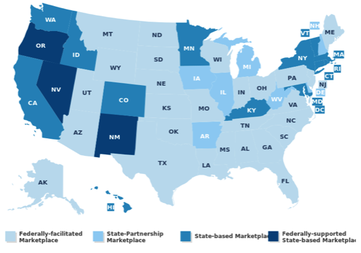

Chances are the answer is yes. Who has had time to focus attention on products in this age of health care reform and great uncertainty in the marketplace? For the last five years stakeholders in the US health care market have wrestled with more questions than answers, all the while preparing for the largest market reform to hit the nation since MediCare. Significant questions loomed about whether or not states would build their own marketplaces or outsource the risky endeavor to the federal government. When the marketplaces were being built we waited on pins and needles for a ruling from the nation’s highest court and a pivotal presidential re-election to direct us where to go next-- and then we raced against time to meet aggressive deadline.

RSS Feed

RSS Feed