By Leesa Tori, President and CEO, The Tori Group

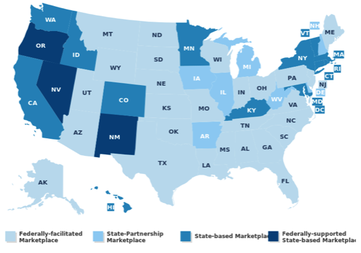

Chances are the answer is yes. Who has had time to focus attention on products in this age of health care reform and great uncertainty in the marketplace? For the last five years stakeholders in the US health care market have wrestled with more questions than answers, all the while preparing for the largest market reform to hit the nation since MediCare. Significant questions loomed about whether or not states would build their own marketplaces or outsource the risky endeavor to the federal government. When the marketplaces were being built we waited on pins and needles for a ruling from the nation’s highest court and a pivotal presidential re-election to direct us where to go next-- and then we raced against time to meet aggressive deadline.

As opening day of the exchange drew close, tricky policy questions about grandfathering of non-ACA compliant plans were debated and last minute decisions confused consumers who didn’t know if they were going to be covered on January 1, 2014 by a plan they were familiar with or forced into a new plan. And everyone is still waiting to understand what the guaranteed issue and individual mandate are going to do to pricing in the long run. Will the new post ACA market actually provide coverage for people who have not traditionally be covered? Or will the churn cycle simple move the same previously insured population around the complex insurance machines that have traditionally served the industry? Is the small group market shrinkage a trend and do insurers care if these changes are improving the P&L? What will market size breakdowns look like in the future? All these questions and more have been proposed and debated and maybe even a few friendly wagers have been made.

But recently, the smoke is starting to clear and we are starting to see a path forward.

Building and running an exchange is harder than some predicted and as hard as others imagined. At The Tori Group we had the unique experience of having run (and eventually retired) the nation’s largest non-profit small business exchange. Few know better than we do how difficult it is to build product portfolios, drive membership and retention, and most importantly build, a sustainable marketplace to withstand the real risk: insurance risk. Too many leaders have fallen into the trap most of our industry remember all too well from the 1980’s: big membership doesn’t mean anything if the membership is unhealthy. The answer to the question of whether or not the marketplaces are going to make it in the long run will take a few more years to figure out-- after we have more experience and early membership and retention numbers to gauge our thinking. For sure the exchanges have had the best open-enrollment they will ever have by now.

The first two years of the ACA marketplaces were the best funded and most media covered events the marketplaces will ever have. While the numbers are impressive in some states (California, Florida and Kentucky) no exchange has established itself as the leader in consumer-purchased coverage. In the case of California the marketplace is a winner for subsidy eligible consumers but for professional non-subsidy eligible purchasers, buying direct from a carrier is more appealing. So what does that mean for product portfolios in this new market? What are consumers and businesses looking for from their health insurance carrier? All good questions but perhaps the most important question and the one we need to be certain to answer correctly is: How can we take delivery and reform initiatives and build new products and powerful portfolios to take advantage of these reforms? How do you take cost saving innovations and translate them to better performing products, and bundle those into winning portfolios that deliver quality care at affordable costs? These are the new questions to be debated. For the right answers and strategies, you need an experienced, informed and clever partner to lead your organization and create new solutions. That is where we can help.

Contact us now to schedule a short demo of Brightside, our proprietary tool we use to help plans assess the strengths and weaknesses of the current portfolio, to build successful strategies.

RSS Feed

RSS Feed